Finalising a divorce often brings relief and closure. One of the key stages in the process is a financial settlement (incorporated into a “consent order”) or an order imposed by the court. This divides assets (including property and pensions) and, if needed, makes provision for income.

Once an order is approved by the court -either following a review of a consent order or after a financial remedy hearing – that settlement becomes a legally binding financial order.

But what happens if new information comes to light? Or circumstances change dramatically?

Many people ask:

- Can I challenge my divorce settlement?

- Can a consent order be set aside?

- Can spousal maintenance be changed?

The short answer is: Upon divorce financial settlements are generally final, but there are narrow exceptions where changes or challenges may be possible.

In this article, we examine when and how a divorce financial order may be changed, including:

- Appeals

- Applications to set aside

- Barder events

- Variation

- Other options

Essentially, when is it over?

What is a Financial Order on Divorce?

A financial order is a court-approved document that legally formalises the division of finances between divorcing spouses.

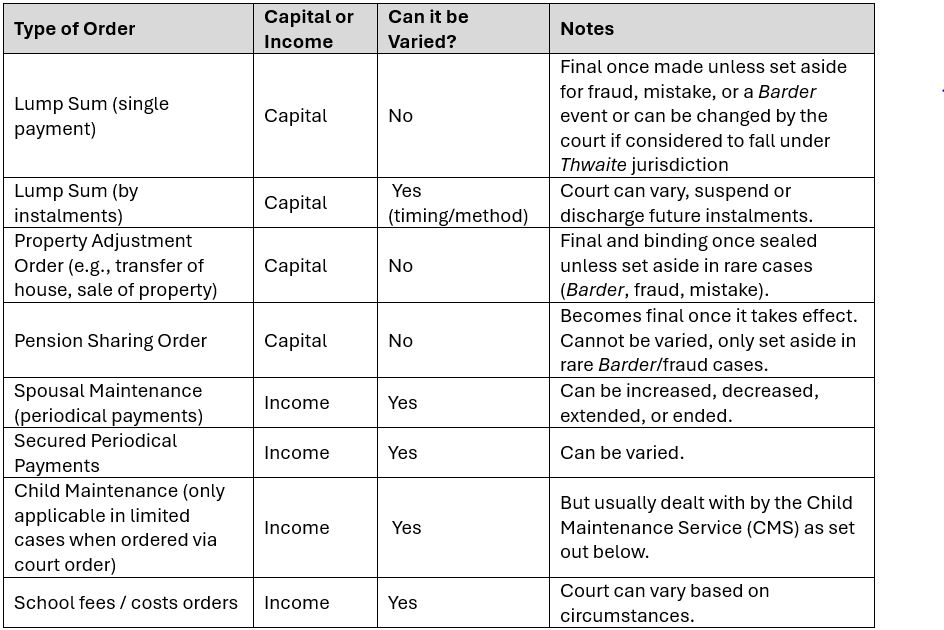

Types of Financial Orders:

- Consent Order – An order which reflects an agreement reached between the parties. This is submitted to the court and, following review, approved by a judge.

- Final Order of the Court– An order made by a judge following a contested hearing. This is usually following the “final hearing”.

Once sealed, on divorce these orders are legally enforceable. They are designed to bring finality and certainty.

Are Divorce Settlements final in England & Wales?

Yes, as a general rule, financial orders on divorce are final. The Family Court encourages a “clean break” wherever possible. The aim is to sever financial ties so that each party can move forward with their lives independently.

The Clean Break Principle

The court must consider whether a clean break is appropriate. Where possible, the court will avoid ongoing financial obligations between parties. Whether this is appropriate will depend on the circumstances of each family and divorcing couple.

The clean break principle is particularly relevant for capital orders, such as:

- Lump sum payments (save in circumstances where payments are made on a deferred or instalment basis)

- Property adjustment orders

- Pension sharing orders

Once made, generally these orders cannot be varied and can only be challenged in exceptional circumstances.

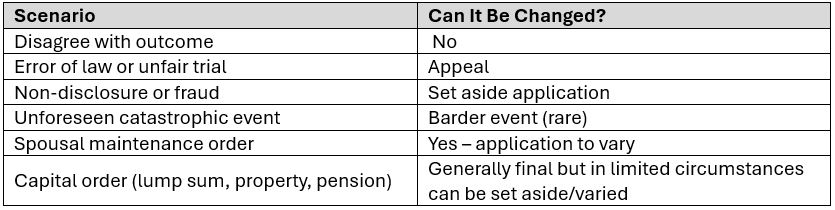

When Can a Divorce Settlement Be Challenged?

There are four main legal mechanisms to revisit or change a financial order:

1. Appeal

2. Set Aside Application

3. Barder Event

4. Variation of Maintenance Orders

These are summarised below:

Appeal

If a financial order was made by a judge (i.e. not by consent between the parties), a party may be able to appeal the decision. There are strict rules in doing so. In outline:

- Grounds. There must be grounds for appeal. This means:

- An error of law (e.g. misapplying case law or statute)

- A serious procedural irregularity (e.g. unfair hearing)

- That the decision was plainly wrong (i.e. outside the range of reasonable outcomes)

- Timing. There is a strict time limit which is usually within 21 days of the date the order was made.

- Permission. Permission to appeal is usually required and granted only where the appeal has a real prospect of success or there is some other compelling reason why the appeal should be heard.

Set Aside Application

In very limited circumstances, you can apply to have a financial order set aside (cancelled) altogether. The court has an inherent jurisdiction to set aside orders where the justice of the case requires it. This is supplemented by case law and specific rules.

Fraud or Misrepresentation

For example, if one party deliberately concealed assets, or lied during negotiations or as part of their financial disclosure.

Material Non-Disclosure

Where one party failed to provide full and frank disclosure of finances, even unintentionally and the effect of this non-disclosure is material to the outcome.

Mistake

If both parties or the court acted under a fundamental misapprehension.

Change in Circumstances

If a major event occurs before the order is fully carried out/implemented and the circumstances of the parties have changed so significantly that it would be inequitable for the original terms to be upheld, the court may intervene.

Criteria for this intervention was established in Thwaite v Thwaite

1. Order still executory (i.e., has not been fully carried out, e.g., sale of the family home);

2. There has been a material or significant change in circumstances;

3. It would be inequitable to enforce the original order as it is.

The court may vary the order, but the order should reflect the original intent of the order. This means that such applications cannot be used as an avenue to create an entirely new order.

Duress or Undue Influence

If a party was coerced into signing the agreement, but beware the evidential threshold to make out this ground is high.

Lack of Capacity

Where a party lacked mental capacity at the time of agreement or approval.

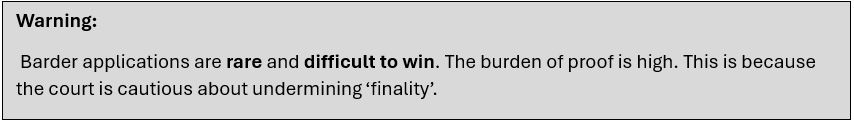

Barder Events – A Rare Exception

A Barder event is an unforeseen, exceptional event that fundamentally changes the assumptions on which the financial order was based.

Origin:

From Barder v Barder – The murder suicide of the wife and the children in this case 5 weeks after a transfer of the matrimonial home rendered the order unjust and the husband succeeded in his appeal.

Legal Criteria (the “Barder Test”):

1. A new event occurred since the order which invalidates the fundamental basis of the order.

2. The event happened within a short time of the order (typically within a few weeks).

3. The application to set aside is made promptly.

4. No third parties have acquired rights that would be prejudiced.

Examples of Barder Events:

- Death of a party shortly after the order

- Sudden and unforeseeable financial catastrophe

- Significant and immediate tax liabilities not known at the time

Variation of Maintenance Orders

Unlike most capital orders, spousal maintenance orders (ongoing income payments) are variable under section 31 of the Matrimonial Causes Act 1973.

You can apply to:

- Increase or decrease the amount

- Suspend or terminate payments

- Capitalise the remaining term (lump sum in place of future payments)

Common reasons for variation:

- Redundancy or loss of income

- Retirement or ill health

- Increase in recipient’s income

- Remarriage of the receiving party (maintenance ends automatically)

What can be varied

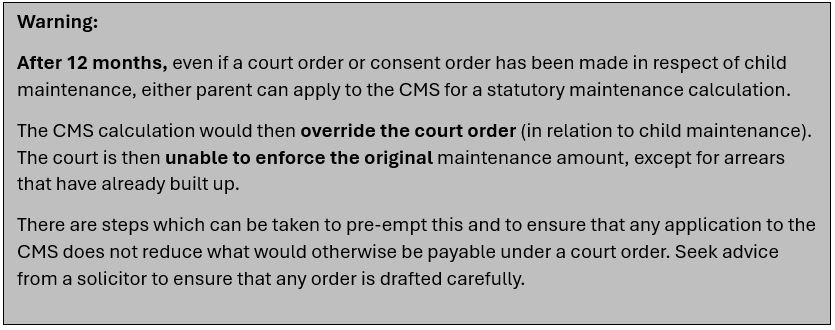

What About Child Maintenance?

Child maintenance is dealt with separately from the divorce settlement in most cases.

Unless specific circumstances apply (including where the paying party earns more than £156,000 gross per year or an order which relates to the cost of education), the Child Maintenance Service (CMS) usually retains jurisdiction over child maintenance instead of the family court.

Parties can, however, agree provisions for child maintenance which can be recorded in a consent order.

Key Takeaways – Can You Change a Divorce Settlement?

Need to Challenge a Divorce Settlement? Speak to a Family Law Solicitor

If you’re concerned about the fairness of your divorce settlement or facing a change in financial circumstances, contact our family law team. We offer tailored advice and can guide you through the available legal options, whether it’s a variation application, a Barder claim, or seeking to set aside an order.

For an initial FREE consultation on any aspect of family law, call Manders Law on 01245 895 105 or email us here.

Note: this blog is intended to give an overview (rather than comprehensive guidance and advice) on your legal or financial position and is provided for information only. It is not an endorsement of any product or service provider.